Overview: Prosper is Bankrates's 2024 award winner for finest private loan for borrowers with fair credit score, and for a great explanation.

Bankrate scores are objectively determined by our editorial staff. Our scoring system weighs various factors shoppers must look at When picking economical services.

Accomplish is additionally best for those who approach on using the money for debt consolidation. Borrowers can score a reduction whenever they use at the very least 85 p.c from the proceeds to pay off current personal debt. Individuals with fantastic credit score or possibly a perfectly-skilled co-borrower can take advantage of a potentially reduced APR by having an Obtain loan.

We Arrange this watch with funded loan details through this lender on Bankrate. This data dynamically updates throughout the outlined day range, ensuring you've usage of The latest, exact Bankrate knowledge on this lender.

Total expense of loan: This is often just how much you’ll pay back, including interest costs, around the expression you decide on.

Homeowners taking over significant property improvements might get reduced charges than recent property equity loans. Cash is often available inside of times as opposed to the weeks or months it may take to close with a home loan loan.

As well as permitting joint applicants, Prosper features a quick funding time and a superb online encounter. As well as, borrowers can improve their month-to-month payment day — a advantage not numerous lenders present.

Pros Provides huge home advancement loans with added extensive repayment phrases No origination costs or late payment fees For those who aren’t happy with the method, LightStream will deliver you $one hundred as a result of its Loan Practical experience Promise software (stipulations use) Negatives Can’t Look at fees with out dinging your credit history Should have great to superb credit history to qualify No extensions on payment because of dates What to understand

Professionals Can Get the loan loaded onto a prepaid debit card Possible to apply in individual, above the cell phone or online Recognized to work with honest to undesirable credit score Downsides Not your best option for outstanding credit score on account of substantial greatest APR Fees an origination price (1.

Present clients may well benefit most from a Citi personalized loan, especially considering that non-customers don't qualify for identical-working day funding. Having said more info that, applicants don't need to be members before starting the process.

Although an FHA cash-out refinance may well seem like a straightforward way to accessibility further cash, it’s important to understand that it includes its possess set of financial obligations. You’ll not only have to pay closing prices, that may vary from two% to 6% from the loan volume, however , you’ll even be chargeable for an upfront FHA mortgage loan insurance policies top quality of one.

Understand lender guidelines and Get the paperwork alongside one another: Although it differs, Use a pay stub, handle and an image ID All set — most lenders demand these for acceptance.

FHA cash-out plans allow for more lenient credit rating scores and versatile personal debt ratios than other cash-outs. That means homeowners can entry their fairness even without having perfect credit rating.

If you can wait up to two organization days, direct deposit is an option. But paying off your loan early with OneMain Monetary is not likely to save you money. It makes use of the precomputed curiosity model. This suggests your fascination relies on your total loan amount and after that added towards your payments Initially of your respective loan.

Destiny’s Child Then & Now!

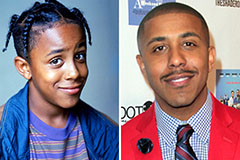

Destiny’s Child Then & Now! Marques Houston Then & Now!

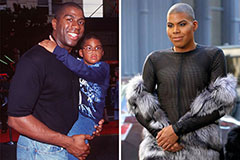

Marques Houston Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!